In the dynamic world of private equity, continuation funds have become a crucial tool for tackling liquidity issues and enhancing value creation. With traditional exit strategies like IPOs and M&A transactions encountering more hurdles, private equity firms are increasingly relying on continuation funds to prolong the lifespan of their investments, offer liquidity to limited partners (“LPs”), and optimize portfolio management. Below is a closer look at the key market trends shaping this space:

Emergence as a Key Strategy: For years, private equity funds’ primary exit options consisted of (1) sale to a corporate buyer, (2) sale to another PE fund, (3) IPO, and (4) reverse merger with a public company. These traditional routes have become less viable in recent years due to soft market conditions. In response, PE firms are increasingly turning to continuation funds (also known as GP-led secondaries), which provide general partners (“GPs”) more time to manage assets until market conditions are more conducive to an exit via one of the traditional methods while still providing liquidity to those LPs desiring it.

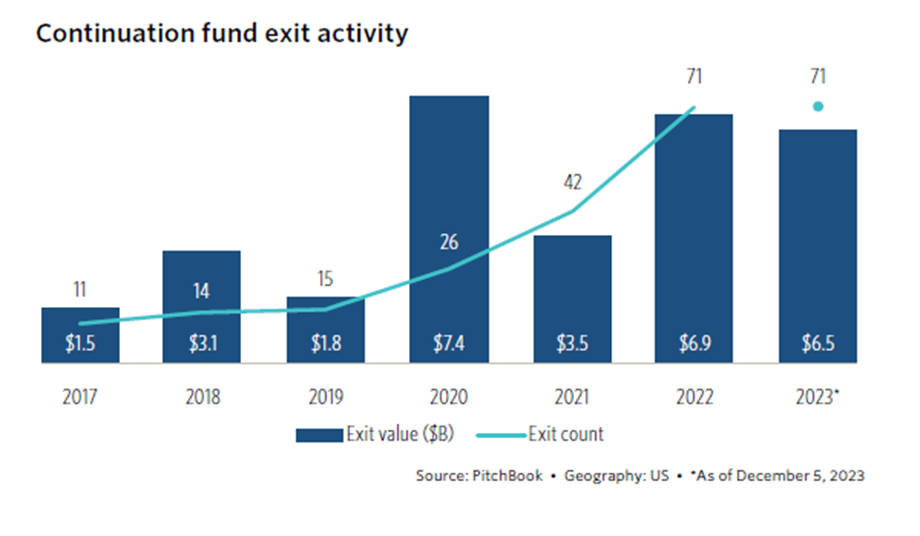

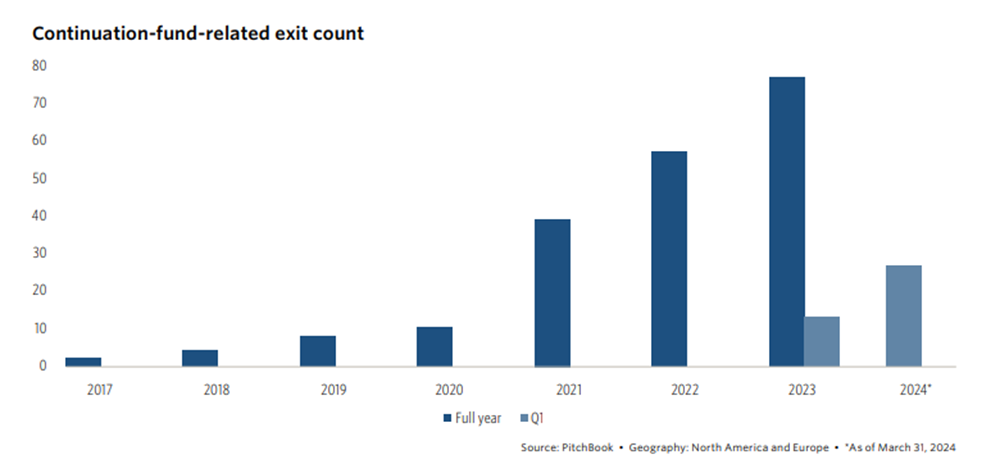

Rising Popularity: Fundraising for continuation funds has surged, with $68.1 billion raised through Q3 2023 (most recent data available), surpassing the $57.6 billion raised in all of 2022, and the trends has shown no signs of abating in 2024 with 27 exits in Q1 2024 compared to just 13 in Q1 2023.

2024 Growth Projection: Continuation funds are expected to hit critical mass in 2024, with Pitchbook projecting exits via continuation funds to surpass 100 such transactions in 2024.(1)

Navigating the Challenges and Risks

GP-led secondaries can be controversial, often facing resistance from LPs. In fact, one-third of these processes failed last year. Obtaining a fairness or valuation opinion from an independent valuation provider has always been best practice and can help assuage LP concerns for the following reasons:

Transparency and Trust: An independent fairness or valuation opinion provides an unbiased assessment of the transaction’s terms, helping to build trust and transparency between GPs and LPs.

Conflict of Interest Mitigation: By engaging an independent third party, potential conflicts of interest are mitigated, ensuring that the transaction is fair and reasonable for all parties involved.

Regulatory Compliance: An independent fairness opinion helps to ensure compliance with the ever-changing landscape of regulatory requirements, which is increasingly important given the heightened scrutiny on continuation fund transactions.

Investor Confidence: A fairness opinion can reassure LPs that the transaction has been thoroughly evaluated and is fair from a financial point of view. This third-party validation increases LP confidence and facilitates securing the necessary consents from LPs, streamlining the process and enhancing the chances of a successful transaction.

How Houlihan Capital Can Help:

At Houlihan Capital, fairness opinions are not a sideline service offering. In fact, we own the domain name www.fairnessopinion.com. Our team has provided valuations and fairness opinions for virtually every conceivable change of control transaction and other complex financings, establishing ourselves as experts in this critical area. We excel in preparing comprehensive documentation to demonstrate that the “Entire Fairness Standard” has been met by a company’s board or special committee. Constantly researching case law on valuation and the Entire Fairness Standard, we extensively publish studies on court-adjudicated judgments related to dissident challenges. Additionally, we possess deep expertise in valuation and navigating complex capital structures, particularly in transactions involving changes of control.

We understand the critical importance of independent valuations and fairness opinions in the realm of continuation funds. As you navigate the complexities of extending the life of your investments and managing liquidity challenges, our expertise ensures that every transaction meets the highest standards of fairness and transparency. Our team is dedicated to providing unbiased, thorough evaluations that instill confidence and facilitate smooth approval processes from all stakeholders.

Discover how our unparalleled experience and commitment to excellence can support your continuation fund strategies. Contact us today to learn more about how our independent valuation and fairness opinion services can enhance your financial and strategic decision-making.

Contact:

info@houlihancapital.com

____________

(1) https://pitchbook.com/news/reports/q1-2024-global-private-market-fundraising-report